Background

Background

After a comprehensive roadshow in which Boubyan Bank met with over 40 investors, the bank announced IPTs in the very low 7% area.

The bookbuilding process quickly reached US$800mn, then US$1bn shortly afterwards, allowing the bank to further tighten pricing into the 6.785% area.

The sukuk was 5.6 times oversubscribed, with a final orderbook of US$1.4bn from 94 accounts. This allowed Boubyan Bank to price the transaction at 6.750%.

Transaction Breakdown

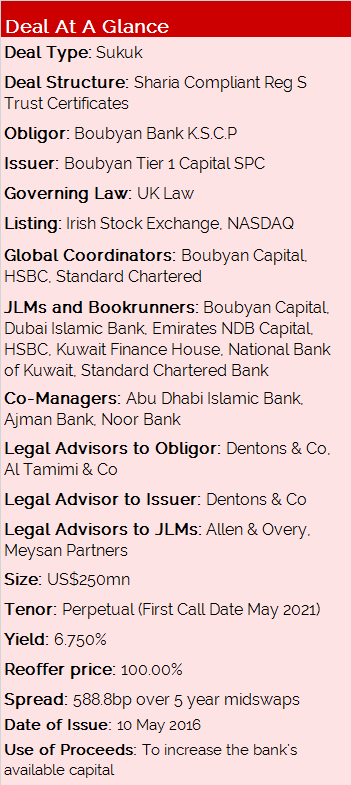

Boubyan Bank’s US$250mn 6.750% sukuk has a perpetual tenor, with the first available call date in May 2021.

The Basel III Tier 1 issuance attracted strong interest as a result of pent up demand for the transaction.

Although the majority of the interest in Boubyan’s sukuk was based within the Middle East, the transaction attracted a large amount of interest from the international community.

This came through roadshows not only in Abu Dhabi and Dubai but also in Hong Kong, Singapore, London, Geneva and Zurich.

The scarcity of the instrument and the rating of the obligor, ‘Baa1’ by Moody’s and A+ by Fitch, both carrying stable outlooks, contributed to the large demand.

“The sukuk not only represents a success for Boubyan Bank, but also a success for the Islamic finance industry and reflects the investment environment in Kuwait and its ability to attract global investors,” said Adel Abdul Wahab Al-Majed, Vice-Chairman & Chief Executive Officer of Boubyan Bank, speaking on the popularity of the sukuk.

Aside from its heavy anchoring in the MENA region, which accounted for 69% of allocations, the bond was relatively evenly spread between other geographies, with European accounts amounting to 13% of demand and Asian accounts constituting 18% of the sukuk’s distribution. There was no American participation.

Banks amounted to 35% of the total distribution by type, whilst international investors and fund managers constituted 31%. Private banks made up 23% and 11% came from insurance companies, pension funds and others.