Background

Background

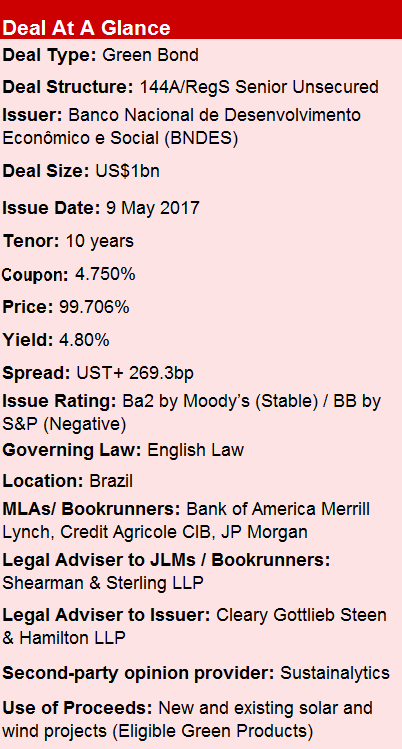

The Brazilian National Development Bank - Banco Nacional de Desenvolvimento Econômico e Social (BNDES) – sought an opportunity to return to the capital markets following its strategic realignment in 2016, which included a shift in focus towards increasing funding for environmentally and socially sustainable projects. The bank largely wanted to refinance existing maturities linked to qualified green and sustainable projects within its existing portfolio.

Off the back of a series of investor meetings, and after seeking second-party opinion on the sustainability of its existing loan portfolio, BNDES was able to price an oversubscribed US$1bn green bond flat to its secondary yield curve and the Brazilian interpolated yield curve.

Transaction Breakdown

The mandated lead arrangers planned a three-day, two team global roadshow that included meeting with asset managers and long-term institutional investors in Boston, New York, Los Angeles, London, and – notably – Paris, an unconventional location for traditional Brazilian dollar issuance.

Each roadshow team included at least one senior director, one member of BNDES’ funding department, and critically, one member of BNDES’ sustainability committee – to be able to address any questions related to the lender’s recently redeveloped green policies and the use of proceeds associated with the green bond transaction.

In addition to traditional credit questions asked of financial institutions (loan loss provisions, concentration of exposure, etc.), investors largely focused their questions on the new role of BNDES in the Brazilian economy, particularly since the bank’s strategic shift in 2016 – which included a management reshuffle, and the use of proceeds. BNDES did not commit to regularly report the environmental impact of the projects, but it did commit to annual reporting on the use of proceeds.

After the roadshow wrapped up in early May, the lead arrangers waited for several days before launching the transaction due to volatile market conditions, eagerly awaiting a window of opportunity.

On Tuesday 9 May, the MLAs launched the US$1bn transaction with initial price thoughts of the ‘low 5% area’ at 9AM Eastern Standard Time. A strong orderbook allowed the lead managers to revise guidance to 4.85% +/- 5bp by midday, which seemed little to deter yield hungry investors.

Demand for the notes surpassed US$5bn, with over 370 accounts – most of which based in the US and Europe – looking for allocations. Huge demand for the notes allowed the leads to launch the transaction at 4.8%, representing a 32.5bp compression from initial price thoughts.

The book was dominated by investors based in the US and Europe, which accounted for more than 80% of the orderbook, and largely subscribed to by asset managers – with limited participation from long term institutional investors and private banks.

Overall, the transaction was a big success, allowing BNDES to achieve its objective of refinancing existing green projects, gaining recognition for this through second-party opinion providers, while pushing out tenors and securing competitive pricing. The notes were priced flat to the lender’s secondary curve and flat to the Brazilian interpolated yield curve, meaning the issuer paid no new issue premium.