Background

Background

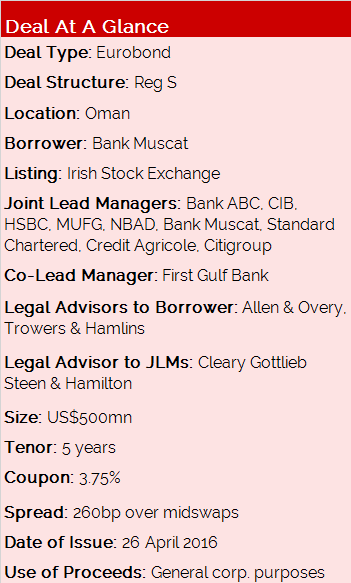

Oman’s largest lender by assets, Bank Muscat, has closed the first debt issuance out of the country since the beginning of the year.

The deal was closed at a time when the markets are heavily saturated due to many issuers in the region looking to finalise their transactions before the start of Ramadan.

Transaction Breakdown

Bank Muscat’s bond was met with large demand, being almost three times oversubscribed, with the orderbook reaching US$1.4bn for a US$500mn issuance.

The high demand for the bond was driven by a number of factors. Caroline Bolle, Group Head of Debt Finance at Bank Muscat said that the general lack of debt issuances from Oman, coupled with the bank’s high credit rating contributed to the increased demand.

Bank Muscat carries a credit rating of A1 by Moody’s Investor’s Service and A- by Fitch Ratings and S&P Global Ratings. All three agencies have a stable outlook.

Bolle noted that both the high demand and strong credit fundamentals allowed the bank to successfully tighten the pricing on the bond, which was relatively tight at 3.75% or 260bp over midswaps considering the economic situation many in the GCC region currently face.

The bank launched the bond at a time when many Middle Eastern issuers are looking to close deals just before Ramadan.

“The small execution window did cause some problems in the run up to the bond’s issuance, although there were no major hurdles,” stated Bolle.

The relatively smooth run up to the bond’s launch attracted a varied investor base. Banks made up 38% of total demand, institutional investors constituted 42% and insurance companies made up 11%. The remainder consisted of private banks and other types of investors.