Background

Background

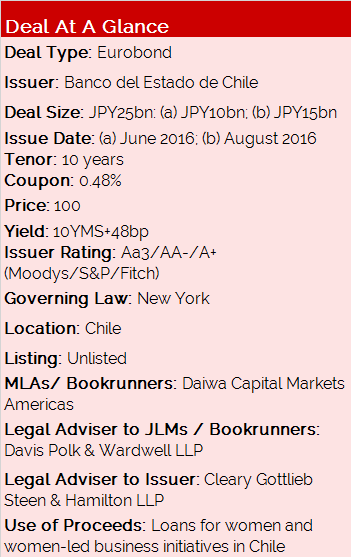

BancoEstado was looking to raise fresh capital outside of Chile to finance its Crece Mujer Emprendedora Programme, which was launched in 2015 to support female entrepreneurs and help improve women’s access to the financial system.

The bank also saw an opportunity to take advantage of lower interest rates (negative at the lower end of the curve) and strengthen its Japanese yield curve by placing a bond on the longer end of the curve, its third issuance in the market at the time.

Transaction Breakdown

In June 2016 BancoEstado teamed up with Daiwa Capital Markets Americas to work on a private placement for the bank.

As this was the first transaction of its kind of BancoEstado, the deal team saw it fitting to test the waters with an initial private placement of JPY10bn in 10-year notes, targeted mainly at large institutional investors and specialised banks with strong corporate social responsibility mandates.

On the back of strong investor demand the bond was placed at 10YMS+48bp, the lowest coupon to be issued to date in the Japanese market from a Latin America issuer.

In August, two months after the bond was placed, the notes were reopened to accommodate for increased demand from Japanese lenders and life insurers. BancoEstado successfully placed a further JPY15bn with these investors, bringing the total outstanding amount of the bond to JPY25bn.

About 25% of the notes were allocated to insurers, 37.5% to banks and 37.5% to specialised lenders. All of the notes were placed with accounts based in Japan.

“With this offering, BancoEstado became a pioneer for Chile in offering Socially Responsible Instruments and joined other SSA issuers that have previously issued this product. Japanese investors in particular have shown a strong desire to support our mission for women enterprise,” said Carlos Martabit, CFO at BancoEstado. “Furthermore, we continue to lengthen our curve in Japan with our first 10yr offering in country as we look to be a more frequent international issuer overall.”