Background

In spring 2017, Globalvia, the world’s second largest transportation infrastructure developer by number of concessions, was exploring its options to finance Ruta 27, the only private toll road in Costa Rica – and as such a critical infrastructure asset that connects the capital, San José, to the Port of Caldera. Autopistas, owned by Globalvia, was looking to refinance existing debt, top up reserves, and pay fees and expenses on the brownfield asset, with a 7-year proven track record and traffic volumes that have exceeded original projections by roughly 60%.

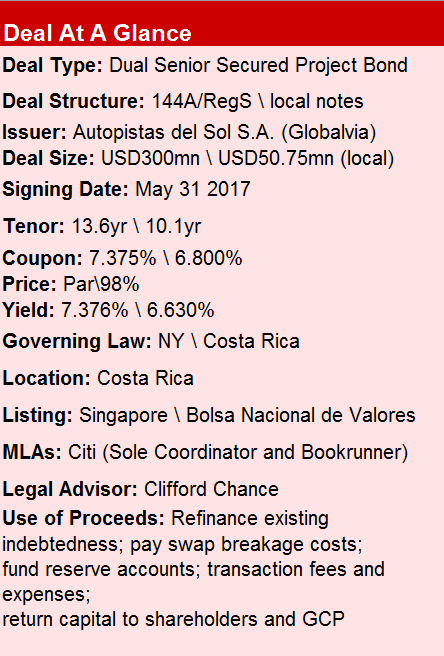

On May 21, Citi, as sole bookrunner and coordinator, helped the company launch its inaugural USD300mn dual 144A/RegS and CRC-denominated notes, achieving multiple ‘firsts’ and shifting Ruta 27’s credit structure from a leverage-covenant based corporate-style bond to a hybrid structured infrastructure bond focused on debt-service coverage ratio (DSCR) with an enhanced cash flow waterfall, thus sustainably increasing the issuer’s debt capacity.

Transaction Breakdown

The book building process involved identifying the right pools of investors (EM focused, regional, local, private, infrastructure-oriented) and securing anchor orders early on. Of note is the fact that the issuer went ahead despite a lack of traffic risk precedents in Latin America and negative market headwinds stemming from a new round of corruption allegations in Brazil.

The 144A/RegS offering followed an extensive roadshow in which the Globalvía team met with over 50 investors in London, Boston, Los Angeles, New York and San José. Initial Price Thoughts (IPTs) were introduced in the High 7% to 8% range and the issuer upsized the deal to USD300mn given overwhelming investor appetite. By the morning of 24 May, the book was oversubscribed by approximately 2.8x, reaching a peak of over USD830mn in orders.

The strong quality of the orderbook allowed the issuer to revise guidance at 7.5% (+/-12.5bp), maintaining a strong book, and ultimately tightening IPTs by 62.5bp. Notably, local investors placed offers worth USD62.2mn, allowing the company to tighten the yield on the Costa Rican bond from 7.25% initially offered to 6.80%.

By type, the bulk of the notes (76%) were allocated to asset managers, a further 12% went to insurance funds and the rest were distributed between hedge funds (10%) and other investors (2%). By region, 77% of the notes were placed with accounts in the US, 19% were snapped up by European accounts and the rest (4%) went to Latin America.

Given the rating (Moody’s: Ba2 / Fitch: BB), in line with the Sovereign, pricing demonstrated the robustness of the structure, which was developed by Citi and included a NPV-related cash trap mechanism that traps cash if traffic outperforms, and mandatory redemptions using funds in the account, which was applied in inverse maturity order of the notes. This NPV cash trap was set up to protect investors under upside cases, but also takes into account investors’ aversion to prepayment risk.

The issue was the first project bond from a non-investment grade Central American country, the first simultaneous offering of International 144A/RegS Notes and local notes by a Costa Rican entity, and the largest bond issued in Costa Rica by a non-government owned institution. The deal also set a new structure and leverage benchmark for Latin American infrastructure issuances.