Background

Background

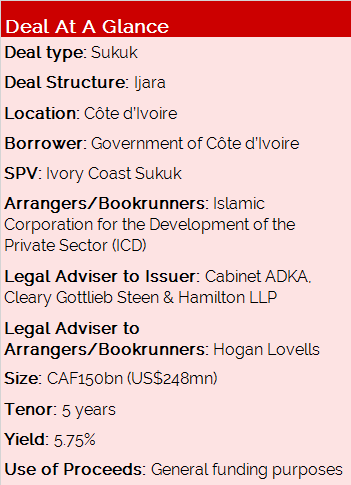

The CAF150bn sovereign sukuk was the first portion of a CAF300bn sukuk programme initially announced in April 2015, part of a broader effort to raise funds for public sector spending between 2015 and 2020.

A deal roadshow was announced in September 2015 and the Islamic Corporation for the Development of the Private Sector (ICD) started taking orders for the sukuk in November 2015, with roadshows held locally within the West African region and Saudi Arabia.

The sukuk was issued on December 28 2015, at a profit rate of 5.75%.

Transaction Breakdown

The Côte d’Ivoire’s inaugural sovereign sukuk is the largest in West Africa since Senegal successfully launched a four-year CAF100 billion (US$171.9mn) sukuk in June 2014.

In terms of allocation, about 56% of the sukuk was placed with institutional and retail investors in West Africa and 6% in North Africa, whilst buyers in the Middle East secured 38%.

The government was fortunate not to have encountered any steep regulatory hurdles, having amended its tax legislation to model similar changes made in Senegal before the sovereign’s debut issuance.

The deal hit the market at a time when bonds issued by other sovereigns were yielding slightly higher (Senegal’s 10-year at 6.3%; Togo’s 10-year at 6.45%), which according to Zakiyoulahi Sow, Director of Sukuk at IDB, highlights the strong relative standing of the sovereign.

“We expected that the market would be more bullish on the deal. At the same time we were issuing, others in the region that had issued during the same period were seeing up to 50 bps more on their deals,” Sow said. “Particularly with investors in the Middle East, we were competing heavily with other issuances in the market at the time, so having nearly 40% placed with investors from that region – especially given that the sukuk was denominated in CAF – was a great result.”

Imran Mufti, a partner at Hogan Lovells who worked on the deal said: “The deal opens up a whole new market for investment in the Côte d’Ivoire, and helps set a precedent for future issuances in the region. Islamic finance is still new for many countries in Africa, but with sovereigns leading the charge it’s only a matter of time until corporates take advantage of Islamic instruments.”