The Market Insights team and GFC Media Group would like to thank all of the finance professionals who nominated transactions for this year’s Latin America Deal of the Year Awards, and for deal teams’ tireless efforts in helping borrowers achieve their core objectives, at the same time developing new structures and techniques to help push the industry forward.

And, last but certainly not least: congratulations to all of this year’s Awards winners. With so many high-quality deals nominated from Brazil and the wider region, this year’s Awards selection was more difficult than ever before.

In view of our Bonds, Loans & Derivatives conference taking place on 4 June at The Tivoli in São Paulo, we wanted to examine some of Latin America’s landmark transactions throughout 2018. wanted to take a closer look at some of the landmark transactions deserving of recognition and originating from the region.

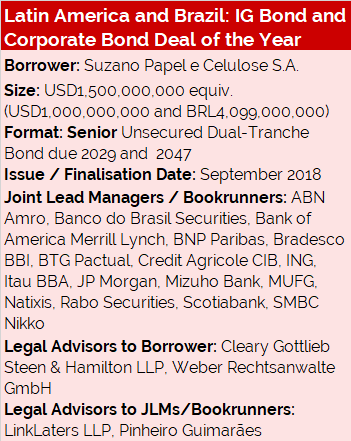

The transaction, which took home the Latin America IG Bond Deal of the Year and Brazil’s Corporate Bond Deal of the Year, came off the back of the companies announced acquisition of Fibria, with the proceeds of the issuance used to partially repay bridge financing agreements and fund the cash portion of the acquisition. Despite increased volatility in global markets – especially in emerging markets, with challenges in Turkey and Argentina casting a pall over the asset class – deal managers were able to effectively tighten final pricing by 25bp, with special mandatory exemptions (contingent on the finalisation of the Fibria acquisition) bolstering investor confidence and leading to a near 3X oversubscription rate.

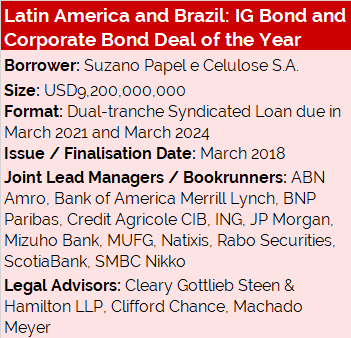

This multi-faceted transaction took home the Latin America and Brazil Syndicated Loan Deal of the Year and formed the funding foundation for one of the most strategically important mergers in Brazil’s recent history (Suzano and Fibria), creating a pulp and paper giant with an estimated 25% market share in the hardwood pulp market. The speed of execution was impressive given the large commitment sizes and the flexibility of the borrowing format allowed Suzano ample room to obtain a capital structure that best suited its needs.

A landmark for the country’s energy sector, this transaction helped finance the largest thermal plan in Latin America and resulted in the first financing for a non-Petrobras greenfield LNG terminal in Brazil. The innovative use of a broad range of funding stakeholders while also attracting top-tier commercial funding partners (despite local currency funding constraints and documentation-related challenges) made this a standout transaction in Brazil and the region as a whole.

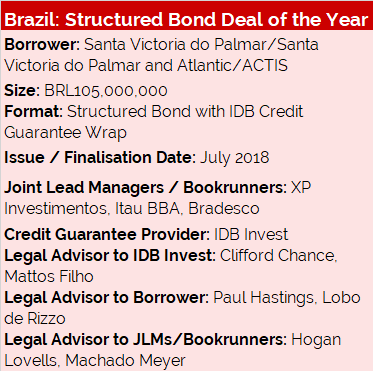

The development of the 207MW Santa Vitoria do Palmar wind farm in the south of Brazil was partly financed through an innovative long-term infrastructure debenture with a credit guarantee wrap provided by IDB Invest, which proved instrumental in helping the borrower secure strong local investment amidst a tough political environment – just months away from the country’s national election. The transaction – which was 5X oversubscribed – was the first in Brazil to make use of the IDB’s Total Credit Guaranty, benefitting from the IDB’s AAA rating to help push final pricing down and tenors out, and helped pave the way for the future use of similar structures in the energy sector among other infrastructure-centric industries.

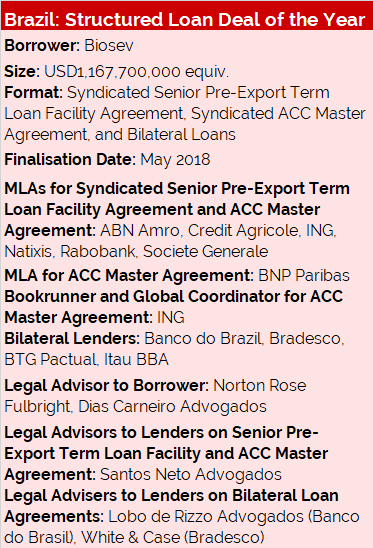

A culmination of six simultaneous but separate multijurisdictional negotiations, this impressive group of transactions was the product of a significant debt reconfiguration programme at Biosev and one of the most ambitious in the Brazilian market during 2018. The transaction enhanced Biosev´s debt profile by significantly reducing its average cost of funding and extending its average maturity, with a 3-year grace period applying to all facilities contemplated in the transaction. Much-needed relief on the debt amortization calendar provided Biosev’s management with precious time to advance the company’s ongoing operational turnaround.

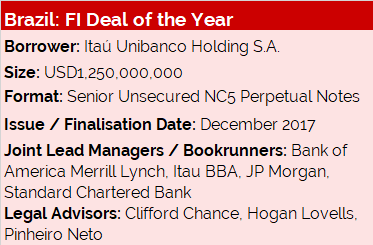

Itaú’s debut additional Tier 1 capital issuance helped optimise the lender’s capital structure following a near 3-year absence from the international debt capital markets. Despite the complex price discovery process – made more challenging by the existence of very few comparable securities in the market – extensive investor engagement helped ensure significant oversubscription and helped the company secure the lowest yield on a Basel III-compliant AT1 security out of the country to date.