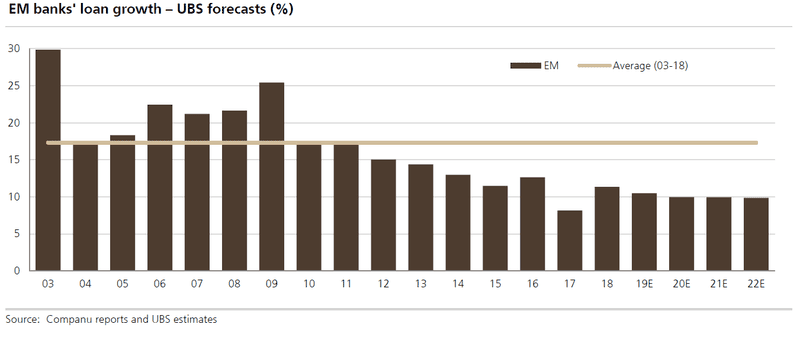

Loan growth will finally pick up in 2020 following a decade of subdued growth, UBS global strategists predicted in their 2020 outlook report. Monetary easing across the emerging and developed world over the past year, a dovish outlook for this year and China’s ramping up of total social financing should prove supportive of credit demand in EMs.

“A strong rebound in the EM credit impulse to 2.7% in November 2019 or 89th percentile of the range since 2011, suggests upside risk to loan growth in EM that we currently forecast at 10% pa over the next two years,” the report states.

Researchers point out that, unlike their developed market peers, EM banks actually tend to perform well with lower rates, and, with further rate cuts expected in 17 countries in 2020 (compared to 16 in 2019), the MSCI EM credit impulse is rebounding strongly and earnings are on the rise.

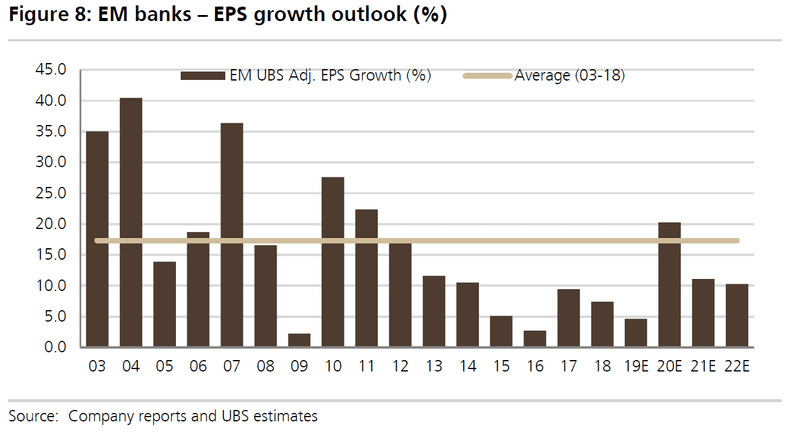

“The profitability and returns of EM banks are underpinned by double-digit loan growth, a margin outlook that could be more resilient than the market expects and favourable asset quality trends. Based on our bottom-up coverage, we forecast EPS growth for EM banks this year in 2020 at 20.3% and 11.1% in 2021 and rising ROEs for the sector to 14.0% in 2020-21.”

Breaking it down by geography, China, Brazil and South East Asia – especially India and Indonesia – will be driving growth in lending, with the latter three coming up to an early stage of the credit cycle.

“Brazil where bottom-up, we forecast loan growth at 15.1% in 2020, India, estimated at 11% up from 7%, driven by private banks, and Indonesia, at 10% from 8%. With continued policy support, we anticipate China loan growth to be stable at 12% pa with asset quality remaining well behaved.”