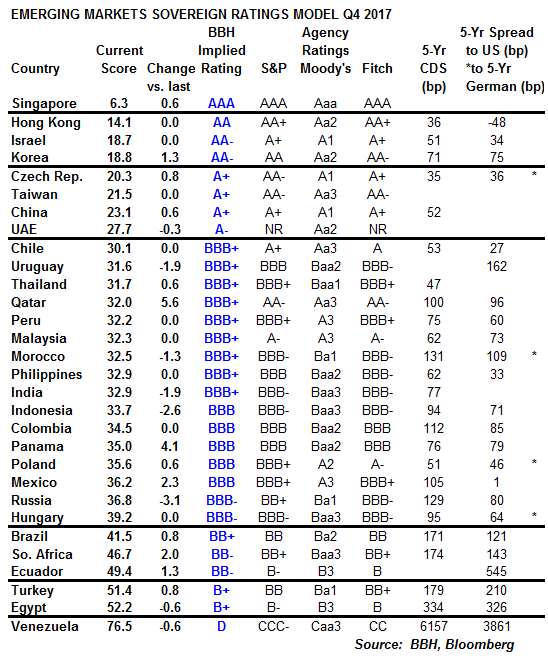

These scores translate into a BBH implied rating that is meant to reflect the accepted rating methodology used by the major agencies. We find that our model is very useful in predicting rating changes by the major agencies. The total number of Emerging Market countries covered by our model stands at 30.

EMERGING MARKETS RATINGS SUMMARY

There have been 11 EM rating actions since our last update. 5 were positive and 6 were negative. For the year so far, 24 negative actions have made up 62% of the total moves, down from 71% in 2016 and equal to the 62% posted in 2015. The outcomes so far this year are consistent with previous years, and were spread out over many countries with little concentration.

Fitch was the most negative agency this past quarter with three negative actions. Fitch downgraded Chile one notch to A with stable outlook, downgraded Qatar one notch to AA- with negative outlook, and cut Venezuela a full step from CCC to CC. On the flip side, Fitch moved the outlook on Mexico’s BBB+ rating from negative to stable and moved the outlook on Russia’s BBB- rating from stable to positive.

Two negative moves came from S&P. It downgraded China and Hong Kong by one notch each to A+ and AA+, respectively. Both have stable outlooks. On the flip side, S&P moved the outlook on Israel’s A+ rating from stable to positive and moved the outlook on Hungary’s BBB- rating from stable to positive.

Moody’s only had one negative move. The agency moved the outlook on Chile’s Aa3 rating from stable to negative. On the flip side, Moody’s moved the outlook on Panama’s Baa2 rating from stable to positive.

Latin America

Brazil’s implied rating was steady at BB+/Ba1/BB+. Actual BB/Ba2/BB ratings still have modest upgrade potential. The economic outlook is poor but improving, and we see scope for further gains in Brazil’s implied rating if the cyclical recovery picks up as we go into 2018.

Chile’s implied rating was steady at BBB+/Baa1/BBB+ after falling a notch last quarter. The fall in copper prices has taken a toll and actual ratings of A+/Aa3/A are still facing downgrade risks, as Fitch’s recent downgrade suggests. Ecuador’s implied rating was steady at BB-/Ba3/BB-, but is still seeing upgrade potential for actual ratings of B-/B3/B.

Colombia’s implied rating remained steady at BBB/Baa2/BBB. This puts it right at actual ratings of BBB/Baa2/BBB, and so downgrade risks have dissipated for now.

Mexico’s implied rating remained steady at BBB/Baa2/BBB. Actual ratings of BBB+/A3/BBB+ are still facing downgrade risks, and we disagree with Fitch moving the outlook from negative to stable.

Peru’s implied rating was steady at BBB+/Baa1/BBB+. As a major copper exporter, the fall in prices fed through into weaker fundamentals. However, the outlook has improved and actual ratings of BBB+/A3/BBB+ appear safe for the most part from downgrade risk.

Uruguay’s implied rating improved a notch to BBB+/Baa1/BBB+. This suggests growing upgrade potential for actual ratings of BBB/Baa2/BBB-. On the other hand, Panama’s implied rating fell a notch to BBB/Baa2/BBB. This puts it right at actual ratings and suggests no more upgrade potential.

Venezuela’s implied rating remained steady at D, though its score improved modestly. While the recent recovery in oil prices will help most oil producers, we think years (decades?) of economic mismanagement have pushed Venezuela to the brink of default and deepening social upheaval.

Asia

China’s implied rating was steady at A+/A1/A+. S&P’s recent downgrade to A+ moves it into line with our model, as well as with Moody’s and Fitch.

Hong Kong’s implied rating was steady at AA/Aa2/AA. S&P’s recent downgrade to AA+ brings it closer to our model. Singapore and Taiwan saw fairly steady scores, with the latter still facing modest downgrade risks.

India’s implied rating rose a notch to BBB+/Baa1/BBB+. Several quarters ago, India was facing downgrade risks to its BBB-/Baa3/BBB- ratings. Now, we are seeing growing upgrade potential.

Indonesia’s implied rating was steady at BBB/Baa2/BBB. Actual ratings of BBB-/Baa3/BBB- are still enjoying some upgrade potential.

Korea’s implied rating was steady at AA-/Aa3/AA-. As such, Korea still faces some downgrade risks to S&P’s AA and Moody’s Aa2 ratings. Fitch’s AA- appears to be on target.

Malaysia’s implied rating was steady at BBB+/Baa1/BBB+. As such, modest downgrade risks to actual ratings of A-/A3/A- remain on the table. Thailand’s implied rating was steady at BBB+/Baa1/BBB+, in line with actual ratings.

The Philippines’ implied rating was steady at BBB+/Baa1/BBB+. There is still some modest upgrade potential to actual ratings of BBB/Baa2/BBB-. However, we suspect that the agencies will remain cautious in light of the planned fiscal loosening by the Duterte government.

EMEA

The Czech Republic’s implied rating fell a notch to A+/A1/A+. As such, we no longer upgrade potential for its A1 and A+ ratings from Moody’s and Fitch, respectively.

Hungary’s implied rating was steady at BBB-/Baa3/BBB-. This matches its actual ratings, and suggests upgrades are unlikely for now.

Poland’s implied rating remained steady at BBB/Baa2/BBB. As such, our model still suggests downgrade risks to actual ratings of BBB+/A2/A-, and we believe S&P’s initial cut to BBB+ last year was just the first of several to come.

Russia’s implied rating was steady at BBB-/Baa3/BBB-. S&P’s and Moody’s ratings of BB+ and Ba1, respectively, appear to have some upgrade potential now. Fitch’s investment grade BBB- rating now seems to be correct.

South Africa’s implied rating fell a notch to BB-/Ba3/BB-. As such, we believe actual ratings of BB+/Baa3/BB+ are seeing even greater downgrade risk. The loss of investment grade from Moody’s seems likely soon.

Turkey’s implied rating was steady at B+/B1/B+ after two straight quarters of decline. We think Turkey still faces strong downgrade risks to its BB/Ba1/BB+ ratings.

Qatar’s implied rating fell two notches to BBB+/Baa1/BBB+, and faces even stronger downgrade risks to actual ratings of AA-/Aa3/AA-. The UAE’s implied rating was steady at A-/A3/A-, which still suggests strong downgrade risk to its lone Aa2 rating from Moody’s.

Elsewhere, Egypt’s implied rating was steady at B+/B1/B+ after rising a notch last quarter. Actual ratings of B-/B3/B are enjoying some upgrade potential. Israel’s implied rating was steady at AA-/Aa3/AA-. As such, actual ratings of A+/A1/A+ still face some modest upgrade potential. Morocco’s implied rating rose a notch to BBB+/Baa1/BBB+. As such, upgrade potential to actual ratings of BBB-/Ba1/BBB- is growing.

CONCLUSIONS

The heavy weighting of negative moves in EM in recent years has continued in 2017. Low commodity prices have had a negative impact on the commodity exporting countries, but those ratings should stabilize if the bounce in commodity prices continues. We continue to warn investors that EM fundamentals will still diverge across countries. The investment climate remains challenging, with fundamentals remaining the most important factor for global investors to consider.