EM FX OUTLOOK

Soft US data and delays to fiscal stimulus plans from the Trump administration has led to a rethink of Fed tightening expectations. While a June hike is still largely priced in, markets no longer view another hike in H2 as likely. Indeed, only one hike is currently priced in for 2018 followed by only one in 2019. The benign global backdrop has helped propel many EM currencies to new cycle highs this month.

One big negative factor for EM FX this past quarter has been lower commodity prices. Here, the outlook remains very volatile as markets struggle with the possibility of persistent excess global supply in several industrial commodities. WTI oil is down nearly 15% from the April 12 peak, while iron ore is down nearly 35% from the April 5 high.

Whatever the pace and scope of Fed tightening is, we still believe it is very important for investors to continue focusing on the fundamentals and on hedging out currency risk whenever feasible. Individual country risk must be monitored closely. We believe investors are being too sanguine on EM, as the current rally is being led by MXN, TRY, and ZAR, all of which face heightened risks.

SUMMARY

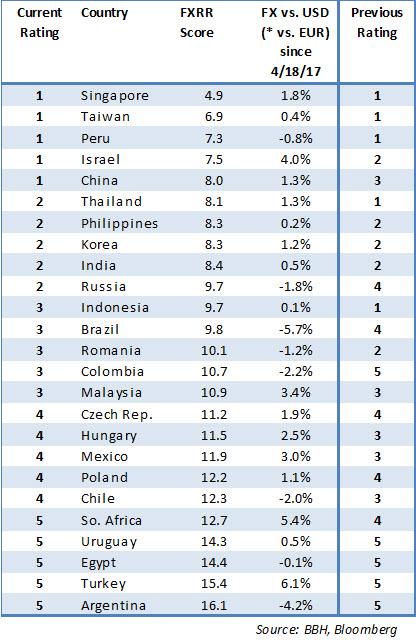

Our FX model is meant to assist global investors in assessing relative FX risk across countries in the EM universe. A country’s score reflects the relative fundamentals. This in turn should tell us something about the likelihood that its currency will outperform the rest of our EM universe over the next three months. With the recent float of the pound, we now include EGP in our model universe, replacing PKR.

We favour the currencies of Asia and, to a lesser extent, EMEA, while Latin America should continue to underperform. Our 1-rated (strongest fundamentals) grouping for Q2 2017 consists of SGD, TWD, PEN, ILS, and CNY. CNY improved from 3 to 1 and Israel improved from 2 to 1, which pushed out THB (from 1 to 2) and IDR (from 1 to 3). Other notable improvements include RUB (from 4 to 2), COP (from 5 to 3), and BRL (from 4 to 3).

With global financial markets likely remain volatile, we continue to recommend focusing on fundamentals as opposed to high carry. Note that seven of the ten top currency picks for Q2 2017 are in Asia. This lines up with our long-held view that Asia is best-placed fundamentally in the current environment. Two of the top ten are from EMEA (ILS and RUB), while PEN is again the sole representative from Latin America.

Our 5-rated (weakest fundamentals) grouping for Q2 2017 are ZAR, UYU, EGP, TRY, and ARS. Note that six of the worst ten currency picks for Q2 2017 are in EMEA, while four are in Latin America. None are in Asia. ZAR worsened from 4 to 5, while RON worsened from 2 to 3. Of note, HUF, MXN, and CLP all worsened from 3 to 4.

Our next EM FX model update for Q3 2017 will come out at the beginning of July. However, we will provide monthly performance updates throughout Q2.

EM FX Model

MODEL PERFORMANCE

Since our model was last updated on April 18, those currencies with VERY STRONG (1) fundamentals have gained an average of 1.3%, while those with STRONG (2) fundamentals have gained an average of 0.3%. This compares to an average gain of 1.3% during the same period for those with WEAK (4) fundamentals and an average gain of 1.6% for those with VERY WEAK (5) fundamentals. Lastly, an average loss of -1.2% was posted by those with NEUTRAL (3) fundamentals.

This past quarter, all five groupings on average saw very similar performances. With markets piling back into EM on the softer Fed outlook, most EM currencies have benefitted from a rising tide. However, we note that there were outliers in all the groupings. Subpar performances for PEN (-0.8%) and RUB (-1.8%) dragged down the performances of the 1 and 2 groups. On the other hand, outsized gains for MXN (+3.0%) and TRY (+6.1%) pulled up the performances of the 4 and 5 groups. Lastly, the 3 group was pulled down by a big loss for BRL (-5.7%).

We think that many of the outperformers during this period (such as TRY, MXN, and ZAR) will revert to being underperformers again when EM weakness resumes. We will continue monitoring and reporting our model performance in the coming months.

MODEL DESCRIPTION

Our FX model covers 25 countries, with each country’s score determined by a weighted composite ranking of 15 economic indicators that are each ranked against the rest of our model EM universe for each category. Categories are external debt/GDP, real interest rates, short-term debt/reserves, import cover, external debt/exports, current account/GDP, export growth, GDP growth, FDI/GDP, nominal M3 growth, budget deficit/GDP, inflation, percentage deviation of the spot rate from Purchasing Power Parity (PPP), political risk, and banking sector risk. A country that is typically ranked first in many of the categories will end up with a low composite score (the lower the score, the better the fundamentals).

The 10 countries that are at the top of our table have VERY STRONG (rated 1) or STRONG (rated 2) fundamentals relative to our EM universe, while the 10 at the bottom have WEAK (rated 4) or VERY WEAK (rated 5) fundamentals. Those five in the middle have NEUTRAL (rated 3) fundamentals. These scores do not imply a greater return for those countries with a higher ranking. Rather, our models simply seek to identify those currencies that are backed up by better underlying fundamentals compared to their EM peers. We stress that the composite rankings contained in this model are a relative measure, not an absolute one.

Furthermore, we are making no assertions about the actual currency returns to investors, as that will involve differences in yield across all the currencies. We are simply identifying which currencies have strong fundamentals and which have weak fundamentals.