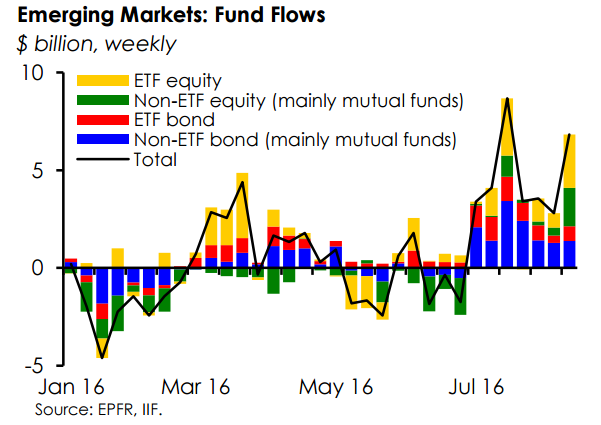

Emerging market bond funds saw roughly US$6bn, with European investors accounting for nearly two thirds of those inflows during that period. At the same time, EM portfolio allocations – at just under 12% - have reached their highest levels since August 2015.

Of those fund flows, investors increased their exposure to Brazil, Peru and emerging Asia and reduced their exposure to Mexico, India and Korea. Exposure to Turkey following the July coup attempt remained fairly stable 2% below average allocation over the past five years.

“Institutional appetite for EM bonds has been robust at around US$870mn per week over the past three weeks – over 10 times the average weekly inflows,” the IIF said in note published late Monday. “Retail investors have favoured EM bonds over equities, recording net purchases of EM bonds for the past seven weeks.”

But the real winner over the past few weeks has been ETFs, a basket of asset saw roughly US$35bn in inflows – about US$28bn of which went into bond funds – since late July, according to the IIF.

Investors are looking to gain broad exposure to higher yielding asset classes, particularly emerging market equities and bond ETFs, as developed market assets continue their flat or negative yield.

These funds have swelled to record levels in recent months. JP Morgan’s USD Emerging Markets Bond ETF (EMB) has raked in US$4.35bn – which is significant for a fund that currently counts about US$9.7bn in total assets; most of that was kicked in by smaller retail investors looking for extra pickup, but larger institutional investors are starting to crave exposure to these funds.

These funds have swelled to record levels in recent months. JP Morgan’s USD Emerging Markets Bond ETF (EMB) has raked in US$4.35bn – which is significant for a fund that currently counts about US$9.7bn in total assets; most of that was kicked in by smaller retail investors looking for extra pickup, but larger institutional investors are starting to crave exposure to these funds.

“You can see a heavily commoditised approach when you consider that most of the funds are flowing to hard currency sovereign debt funds, despite the fact that local currency corporate debt is performing much better,” said one analyst at a London-based insurer. “People obviously crave exposure [to EM assets] in the low yield environment, but aren’t being particularly picky.”

Pricing anomalies are starting to become more prevalent in the EM credit world. Tupras, the Turkish oil refiner, has seen its share price drop by almost half since March on the back of poor quarterly performance and oil market volatility, but yields on its 2018s have barely moved 50bp overall – despite a brief spike following the attempted coup in July. Embraer, the Brazilian aerospace conglomerate currently embroiled in a bribery scandal in the Dominican Republic, has seen a similar dislocation between the macro Brazilian environment, its share price, and where its bonds are trading.

These dislocations are baffling for analysts, and investors are increasingly worried that massive imbalances in liquidity is to some extent causing them. Precisely measuring the impact of a significant liquidity influx is difficult beyond simply observing broad spread compression, but one would expect more volatility if money flows to more commoditised liquid assets like ETFs, particularly if the rate environment shifts.

“When ETFs are liquidated they are essentially indiscriminate – like a shotgun blast to the market. The market cap for EM ETFs has gone from US$4.8bn to US$9.5bn since March,” said Greg Saichin, CIO Global Emerging Markets Fixed Income at Allianz in London.

“[ETFs] only represent US$5bn of the US$23bn that has come through cumulatively, but at the end of the day if you have all of this indiscriminate money coming in and bidding everything across the board, it will have an effect on pricing.”

“Things that are tight are going to be way tighter, and the opposite is true going the other way – that’s what is to come,” he said.