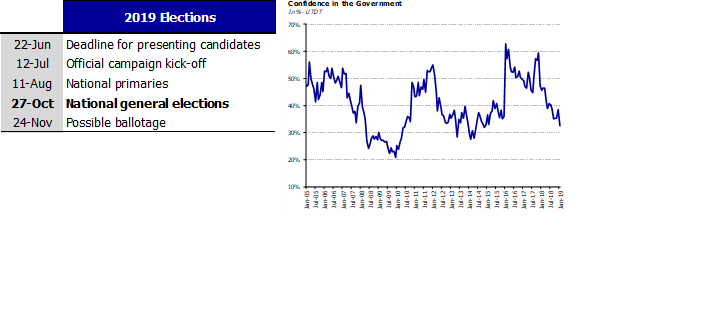

Argentina is quickly entering the election mode, as many forecasts and economic decisions are made with one eye on the opinion polls, assessing of the prospect of Macri´s re-election. While we are still at the early stages of the electoral process, it seems that in the end the choice will be between Cristina Kirchner and Mauricio Macri, with majority of polls indicating that Macri has a slight edge.

True, much can happen between now and October 24th, when the first round of the presidential election will take place, but at this stage it seems that by October the economic conditions will improve. However, one needs to be realistic, and the best that one can expect is an economy that by then will have left the recession behind and entered a period of moderate growth (perhaps at an annual rate of 3%), that would kickstart the jobs market; the exchange rate will, in turn, depreciate in line with domestic inflation, avoiding sudden jumps, and the rate of inflation will remain stable in the two percent per month range. It is by no means a rosy scenario, but at least a better one.

What can derail this scenario of broader improvement in economic conditions? One obvious suspect is the FX rate, where a sudden depreciation could erode confidence in the government. A second one is further deterioration in international financial conditions across emerging markets. A third one is the possible delay of the economic recovery, which is currently expected to gain momentum in the second quarter.

What can derail this scenario of broader improvement in economic conditions? One obvious suspect is the FX rate, where a sudden depreciation could erode confidence in the government. A second one is further deterioration in international financial conditions across emerging markets. A third one is the possible delay of the economic recovery, which is currently expected to gain momentum in the second quarter.

History indicates that even if overall economic and financial conditions improve, the path is unlikely to remain smooth and there is likely to be volatility along the way. The main question is whether the government has the necessary policy tools to deal with the unknown - but expected - shocks.

What’s in the Toolkit?

At the moment, it seems that the Central Bank has very limited capacity to respond effectively to movements in the exchange rate, if it maintains the current exchange rate regime of very wide non-intervention rate bands. The Treasury has some scope to act, if it uses the dollars it has been receiving from the IMF, though its effectiveness remains an open question, as it has not yet defined how and when it will intervene.

The bottom line is that there are still doubts about the ability of the government to respond effectively to pressures in the FX market. This is an area where the government needs a higher degree of freedom and where, hopefully, the IMF will become more flexible in the near future.

A recent test to FX volatility took place after the release of January CPI figures above consensus (2.9% monthly to accumulate nearly 50% year on year) coupled with a cut in interest rates that was very aggressive (15%). The Peso slumped from 37 in early February to 40.5 in a few days and the Central Bank had to intervene in the futures markets (allowed by the IMF Stand By Arrangement) and to undo 5 percentage points of the interest rate cut. Quick reaction by the Central Bank stabilized the Peso in the 39 area, sending a clear message that reining in inflation is important but stabilizing the foreign exchange market is vital.

The second challenge is to find ways to stimulate the recovery if the economy remains sluggish. In this area there are also very few options, as the government is reducing expenditures and raising taxes, and neither of these policy actions will help the expansion in the short run. Under normal circumstances this type of reduction in the fiscal deficit could provide a stimulus to economic activity by reducing Argentina’s country risk and improving access to external credit. Unfortunately, this transmission mechanism is not working fully at this stage and credit spreads are unlikely to drop significantly in the next few months, due to the elections-linked uncertainty.

It will also be difficult to stimulate economic activity through monetary policy, as the current stance of limiting the growth of the monetary base means that monetary policy will remain tight - at least until June, when the monetary targets will be revised. True, the recent easing of interest rates provides some breathing room for the growth of credit, but on the whole interest rates remain high. Perhaps there is room to come up with some credit lines to stimulate consumption or to finance investment (as was the case in the past), though those measures are more likely be implemented closer to the elections.

Despite the risks and the limited policy tools that the government now has, the economic and financial situation is likely to improve as we head into the election period (August 11th being the first milestone). If there are no other surprises, inflation is likely to fall, credit conditions will improve, economic activity will recover, and the exchange rate will remain relatively stable. The main threats to this constructive scenario are changes in the international financial environment and potential volatility in FX.

“Divorcing” Financial and Economic Indicators

“Divorcing” Financial and Economic Indicators

Since the beginning of the year the economy has been sending mixed signals. On the one hand, there has been a clear improvement in the economic fundamentals (i.e. lower fiscal and current account deficits, a slightly undervalued currency, etc.), as well as in most financial indicators (namely the stability of the exchange rate, with the exceptions of some volatility after the release of January CPI, the drop in domestic interest rates and in the level of country risks).

On the other hand, most “real” indicators of economic activity are still showing deterioration, namely significant falls in industrial production, in construction, in retail sales and in employment. This discrepancy in the behaviours of the real and financial variables that we observe is not necessarily a contradiction; instead it reflects the different speeds of adjustment of both types of variables. Typically, financial variables are a leading indicator of the evolution of the real side of the economy.

In fact, last year the depreciation of the currency and the increase in interest rates and in country risk started in the first quarter of the year, and clearly preceding the deterioration in real-side indicators, which began end Q2 and only became apparent in Q3. As a result, we do expect that if the current improvement in the financial indicators can be sustained, it will be followed by a better behaviour in overall economic activity.

So how much has the financial climate improved? According to the Index of Financial Conditions (ICF), which is calculated jointly by the IAEF and Econviews, the overall financial situation is now in positive territory, and the recent evidence suggests that it is likely to be at a turning point. In the past, this index was a useful tool for anticipating shifts in the economic activity. The level, though positive, is still not strong enough to suggest a quick recovery, though at least it remains in the “comfort zone”.

This improvement in financial conditions is in part explained by the stabilization of the exchange rate since last October. While the monetary policy moves contributed to this newfound stability, one needs to keep in mind that it coincided with a period in which emerging market currencies (especial the Brazilian Real) have also remained very stable.

A second factor that has contributed to the improvement in financial conditions is the drop in interest rates, as the reference Leliq rate fell from a peak of 74% in early October, to 60% in December and to around 50% more recently after touching 44% by mid-February.

Stubborn Inflation

While interest rates are falling, inflation is showing significant persistence, and it is not expected to drop below 2.5% till April or May of this year. While inflation is likely to persist for some time, we might not see another relapse in which the monthly rate of inflation shoots up to 4-6%, namely because those episodes were driven by large step depreciations of the currency, (which we do not expect to repeat).

The most likely scenario is that inflation will be converging towards the end of the year towards monthly rates of around 1.5 or 2%; the disinflation is likely to be slow but tangible.

The most likely scenario is that inflation will be converging towards the end of the year towards monthly rates of around 1.5 or 2%; the disinflation is likely to be slow but tangible.

One critical issue is now is about when and how fast the economy will recover from the recession. Recently published batch of indicators of economic activity, mostly covering the period of 4Q2018, remain in the “red”: construction is down 20.5% y/y, industrial activity -14.7% and retail sales -11.1%. The recession has been deeper and longer relative to what was initially expected.

The recession that started in Q2 2018 is now likely to last four quarters, and the normalization process is expected to be gradual; we are forecasting a U shape recovery as opposed to a V shape one. The improvement in financial conditions will help, though not as much as in other episodes, because Argentina’s credit spreads remain at levels that leave it cut off from long-term financing.

Unlike the recent rebounds in economic activity that were driven by private consumption, this time the recovery will be driven by exports and the agriculture sector, where there is a forecast for a very good crop. The increase in real wages and pensions to catch up with past inflation will take place very slowly and that leads us to forecast a tepid performance of private consumption.