Recent headlines present optimistic news for Brazil’s credit markets. On October 28, 2016, Valor Econômico – a major Brazilian business journal – published an article under the headline “Business Credit Risk Signals Improvement,” written by Thais Carrança. Carrança cites generally optimistic reports from the three global credit agencies: Fitch, Moody’s, and Standard and Poors. In addition, the October 4th report from Serasa/Experian – a major credit bureau in Brazil – reveals that bankruptcies peaked in July 2016 in Brazil and have declined in almost every category over the last few months.

Latin America Structured Finance Advisors, in conjunction with our partners in Brazil, used analysis of the buckets for ageing bad loans to verify the findings of the rating agencies with an analysis of bad loans in 49 credit portfolios of Brazilian ABS. We found that most of the bad loans have reached 180 days past due and the percentage of delinquent loans in the earliest ageing buckets have fallen below pre-2015 levels. This supports our view that Brazil’s credit crisis has peaked.

Improving Credit Conditions

In its October 28th article, Valor reports “all three of the major global credits ratings agencies see the prospect for a gradual improvement in Brazilian credit.” Carrança quotes Diego Ocampo from S&P Global Ratings, “In the last 12 months, the conditions for Brazilian companies did not worsen, and for some of them actually improved.”

Moody’s also sees better credit conditions. Carrança writes, “Moody’s expects the delinquency rate for speculative Latin American companies to fall to 4.3% by September 2017 after a peak of 5.5% in August of this year.”

The credit agencies are relying on several political and economic indicators in reaching their conclusion. First, Brazil is resolving the Lava Jato inquiry and the resulting political crisis in a democratic fashion. On the economic front, Brazilian inflation is falling and the Central Bank of Brazil has started lowering interest rates. Liquidity for Brazilian companies has improved as some have succeeded in issuing new debt in the global credit market, even though they had to pay significantly higher spreads.

While Fitch believes in the Brazilian recovery, it is not as optimistic as Moody’s according to Valor. Ricardo Carvalho, Senior Director of Corporate Finance in Brazil, is quoted as saying that “the worst of 2016 has not passed.” According to Carvalho, the balance sheets for major companies indicate that there will be a continuous increase in debt through the end of the year and that the main challenge will be rolling the debt.

He goes on to point out that the ratio of downgrades to upgrades should reach historically high level of 16.5 times (33 downgrades versus 2 upgrades). This ratio was 5.2 times in 2016 and 2.8 times in 2014 according to Carvalho and Valor.

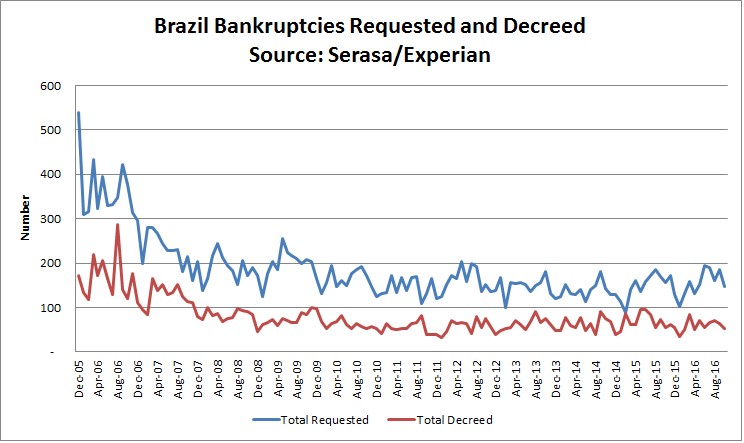

On November 4, 2016, Serasa/Experian published a report “the Number for Judicial Recoveries falls in October.” According to data from their system, the number of Judicial Recoveries Requested fell from 244 in September 2016 to 121 in October, however, it was still higher than 102 in October 2015. The year-to-date number for Judicial Recoveries Requested has grown 57.6% versus the same period in 2015. See Exhibit I.

Exhibit I

All the data indicates that the worst is over for Brazilian credit. The key to verifying this new trend is to understand the Brazilian credit cycle and the Brazilian economy’s current position in that cycle. Lenders put non-paying creditors through an aging process that classifies a delinquent borrower based on the days past due. Brazil tends to follow the Central Bank of Brazil (BCB) format, 30 days past due, 31 to 60 days, 61 to 90 days and so on. After 180 days, Brazilian lenders must value the loan as worthless when it reports to the BCB.

We would expect bankruptcies to grow if the number of delinquent borrowers in the early buckets is growing, since this indicates that more delinquencies will continue to age until they reach the 180 day bucket and bankruptcy courts (Usually after 90 days). Loans in the 180-day bucket tend to stay there for a while and accumulate as they wind their way through Brazil’s courts.

However, if the number of loans passing through the early buckets is falling and has returned to normal levels, then we can expect the number of bankruptcies to peak and then possibly fall as fewer loans reach the 180-day bucket. In this situation, bankruptcies may not fall quickly since it takes time for the courts to work through the backlog of bankruptcy petitions.

Latin America Structured Finance Advisors (LASFA) worked with our partners in Brazil to evaluate more than 49 Fundos de Investimento in Direitos Creditórios (Brazilian Asset-Backed Securities known as FIDCs). We looked at credit ageing for 2016 and compared it to 2015. The FIDCs all specialized in factoring – a type of receivables financing. We found that the levels for delinquent loans have returned to normal in the third quarter of 2016. The decline can be seen in the red, green, purple and orange bars. See Exhibit II and III.

Exhibit II

* Risk adjusted asset – Original assets minus credit losses

Exhibit II shows the percentages based on total risk-adjusted assets (delinquent loans in the bucket divided by total assets). We can see that the total value of the loans in the “greater than 180 days” bucket is growing. However, the percentage of loans in the early buckets, say 61 to 90 days, has peaked and dropped below the levels seen in 2015.

Exhibit III calculates the percentage using the total delinquent loans in the denominator. It looks at the percentage of bad loans in each bucket. It clearly shows that the amount in the green buckets, 31 to 60 days, has been declining steadily since 2015.

Exhibit III

The table in Exhibit IV shows the dates that the percentage of bad loans peaked for each aging bucket. With improving credit conditions, we would expect that the mass of bad loans would pass through each aging bucket and that the percentage in each bucket would decline as credit conditions improve. That is the exact behaviour that we see in Exhibit IV and it verifies that credit conditions are improving, even for smaller companies.

Exhibit IV

One note of caution with respect to Exhibit III and IV, some finance companies and FIDC operators are reporting that the credit quality of their loan portfolios, as measured by bad loans divided by total loans, is improving because they are seeing an influx of new clients as banks pull back from offering more credit. Higher credit quality businesses that had dealt exclusively with banks are now using FIDCs for their credit needs.

LASFA continues to monitor this migration of borrowers; however, we believe that we would have seen a sudden drop in the levels of all of the ageing buckets if this migration was responsible for the bulk of improvements in credit quality of FIDC loan portfolios. Given that the improvement in these portfolios progressed in an orderly manner through the ageing buckets, we feel that the FIDC industry – and the lending sector in general – has absorbed the recent credit problems and effectively survived one of the worst economic cycles in the history of Brazil.

Conclusion

We are exercising cautious optimism. Economic and political conditions have begun improve in Brazil. However, Brazil’s economy still faces many challenges: high unemployment, indebted local governments, high interest rates and slow business activity will be a drag on the nascent recovery.

However, credit investors should not wait for a healthy economy and lower interest rates to start lending. Brazil is no longer in economic free fall and while it is not roaring back from the abyss, it has stabilized. All our indicators show that the 2015/2016 Brazil credit crisis has peaked. Our analysis shows that the bulk of the bad loans have passed through the ageing bucket and that the number of bankruptcies will also begin to decline since the number of delinquent loans in the system returned to pre-2015 levels. These developments indicate that the time has arrived to invest in Brazilian credit.

This report was written by Vernon H. Budinger, CEO, Latin America Structured Finance Advisors, LLC.. Latin America Structured Finance Advisors, LLC is a California company that specializes in structuring financial vehicles to invest in credit in Brazil and other countries in Latin America. The company has developed financial models to track the vehicles and manage risk. www.latamstructuredfinance.com