Economics and Markets

Kenya’s Real Estate Sector Not Heading for a Bubble – Cytonn Investments

Despite a boom in Kenya’s real estate sector in recent years the market is not currently in a bubble, argues a recent report from Cytonn Investments. A bubble is unlikely, the report argues, due to a lack of access to credit, without which unsustainable demand cannot be supported.

31 Jan 2020

Spike in Africa Eurobond Maturities in 2024, 2025 Shouldn’t Overwhelm Sovereign Refinancing – M&G

Despite elevated idiosyncratic risk and concerns around emerging market sentiment more broadly, a spike in African Eurobond maturities in 2024 and 2025 is unlikely to overwhelm the sovereigns’ ability to refinance their bonds given advances in active debt management and a positive track record of repayment, according to M&G Investments.

29 Jan 2020

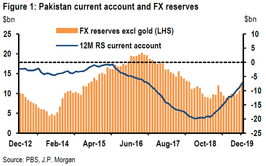

Pakistan’s External Balance Improved More than Expected Under IMF Programme – JP Morgan Securities

The USD6bn loan to Pakistan approved by the IMF in mid-2019 has gone some way to helping stabilise the country’s economy in the face of domestic and external headwinds.

29 Jan 2020

Strong Link Between Prosperity and Emissions Undermines Sustainability Push

The research casts doubt on feasibility of combining high economic growth targets with sustainability objectives, with potential implications on development of “green finance” markets.

29 Jan 2020

Global Interest Rates Outlook: Lower-for-Longer

The underlying factors behind low interest rates are unlikely to change in coming years, meaning that the near-zero yields are here to stay, Moody’s analysis suggests.

28 Jan 2020

Africa-Russia Economic Linkages Will Struggle to Expand Beyond Security, Arms, Soviet Vestiges

There seemed to be no shortage of talk in 2019 around bolstering commercial and trade links between Russia and a number of African countries, but after high-level summits and dozens of press releases, industry observers see limited scope to expand those economic linkages beyond security, arms, and soviet vestiges.

28 Jan 2020

Geopolitical Policy Uncertainty, Asset Quality Deterioration, Vulnerability to Fickle Investor Sentiment Weigh on EM Banks – Especially in Turkey

Global and domestic tensions that could threaten policy continuity, asset quality deterioration, and shifting emerging market investor sentiment remain to remain the dominant risks for emerging market banks in 2020, says S&P Global. Turkey remains particularly vulnerable.

27 Jan 2020

Global Soybean Supply to Fall Due to Lower US Production – ABN Amro

Whilst the phase one trade deal brokered between the US and China is only temporary, it is beneficial for sentiment towards agricultural commodities, argues a recent report from ABN Amro.

27 Jan 2020

GCC Fixed Income Ourperformed All EM Peers in 2019 - Markaz

The GCC fixed income market outperformed all other emerging markets in 2019, delivering a return of 14.5%, as represented by the S&P GCC bond index.

27 Jan 2020

China Coronavirus Could Weigh on Oil, Tourism, Travel Industries

The recent outbreak of coronavirus in China – which comes around the same time as the Lunar New Year, a peak travel season in the country – could have dramatic affects on a range of commodities and industries, analysts suggest. But it is too early to tell how extensive markets would be moved.

27 Jan 2020