Subscribe for access:

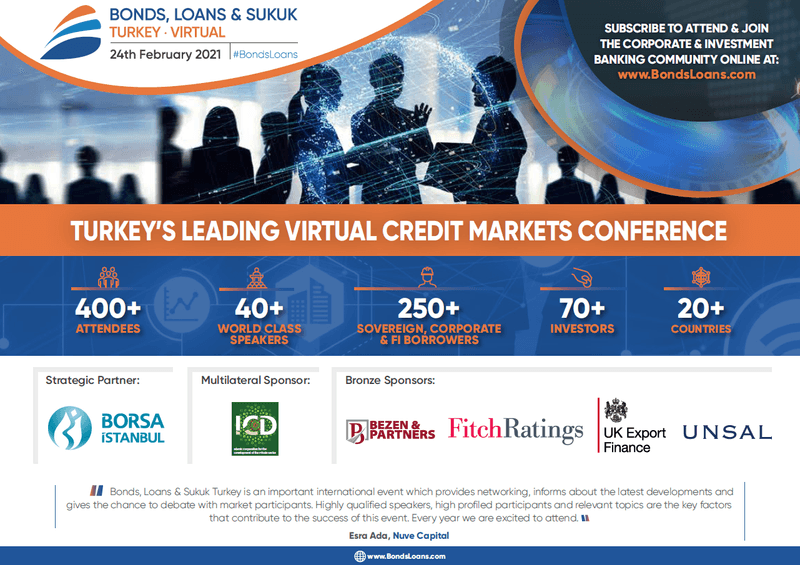

BONDS, LOANS & SUKUK TURKEY 2021 VIRTUAL CONFERENCE

ON-DEMAND VIDEO RECORDINGS FROM THE VIRTUAL CONFERENCE ARE NOW AVAILABLE BELOW

400+ Attendees | 40 + Speakers | 200+ Sovereign, Corporate & FI Borrowers | 70 + Investors

This event gathered Turkey's borrowers, investors, bankers, policy makers and market practitioners to share knowledge, debate and network.

Turkey’s largest corporate and investment banking event was on our Bonds & Loans online platform in 2021, giving you the ability to connect with even more C-level decision-makers than you would at a physical conference in less time. The event was a unique opportunity to setup an unlimited number of virtual meetings with the 400+ senior government official, regulator, investor, banker and corporate attendees via our 1-2-1 networking platform; to hear from the local and international markets’ leaders speaking on our panels; and to showcase your market expertise by speaking alongside them.

Livestream Agenda

Macroeconomic outlook: Taking Turkey’s economic temperature post-health crisis and beyond

Wed 24th Feb 2021, 6:15am (Europe/London)

- Geopolitics and the economy: Analysing the new relationships with US and Europe, and their impact on trade and FDI

- Turkey’s monetary policy and its impact on growth rates, inflation, TRY/US and international investor sentiment

- How does Turkey fight rising inflation: Rate hikes or FDI/IMF support? What are the consequences for the wider economy of each?

- Cyclical vs. structural: What are the short-term cyclical pressures caused by COVID-19? And what are the long-term structural shifts uprooted by the pandemic and have changed the trajectory of Turkey’s economy?

Moderator

Chief Executive Officer

Speakers

Economist

Emerging Market Sovereign Strategist

Research Director

Senior Economist

How to access the international markets despite slowing GDP, rising inflation and ratings pressure

Wed 24th Feb 2021, 7:00am (Europe/London)

- Where do investors see value in the Turkish credit markets? Who can access the market and at what price?

- How can/have corporates successfully issued despite the challenging economic backdrop and pressure on ratings?

- Ratings landscape and regulations on foreign currency: What are the obstacles for bank issuers to access the markets?

- Can Turkey’s project sponsors sell bonds to international investors to refinance their project finance loans?

- Out with the old and in with the new (benchmarks): How has a changed macroeconomic landscape trickled down into pricing, spread, duration? What does the new normal for Turkish issuers look like?

Moderator

Head of MENA Debt Capital Markets

Speakers

Managing Director, Financial Sector

Chief Executive Officer

Head of Corporates, Middle East and Africa, Analytics

Group Chief Financial Officer

Deputy Country Head of Türkiye

Green, social and sustainable: Can ESG and SDG bonds offer an alternative route to access new pools of capital?

Wed 24th Feb 2021, 8:00am (Europe/London)

- Greenium effect: Is there more liquidity coming into deals that are SDG-linked or Green?

- How “green” does green need to be? How “sustainable” does sustainable mean? What do issuers need to do to successfully tap into the Green, ESG and SDG-linked pool of liquidity?

- How much more work is it for institutions to meet ESG criteria of investors? What are the first steps for institutions that are from less environmentally-friendly industries and sectors?

Moderator

Senior Director, Sustainable Finance

Speakers

Chief Executive Officer

VP Thematic Credit

Advisor

Global Head, Sustainable Bonds, Debt Capital Markets

Partner

Extend, refinance or restructure: How companies can continue to manage liabilities and repayment obligations through the pause in economic activity (in Turkish)

Wed 24th Feb 2021, 9:00am (Europe/London)

- Should corporates restructure today with a one-time solution, extend for six months in the hope of improved credit conditions, or look to refinance?

- Projects put on hold by COVID: Force majeure? Renegotiate? Repayment extension? What is the cost of refinancing in today’s market versus the all-in cost of delaying and waiting 12 months?

- Has the health pandemic caused a short-term cyclical slowdown in activity or a permanent structural shift? How do the options (restructuring, extending or refinancing) vary depending on sector?

- Financing and refinancing through the current FX volatility

Moderator

Managing Partner

Speakers

Director of Corporate Loans and Project Finance Restructuring Department

Partner

Chief Executive Officer

Chief Financial Officer

Underwriting and syndicating loans in Turkey: Who is lending, at what price and on what terms?

Wed 24th Feb 2021, 9:45am (Europe/London)

- What are international banks’ approach to lending in Turkey? Who can borrow and at what price?

- New deals, new liquidity: Which banks are active in the market? How are banks becoming more selective?

- Liquidity and cost of funding: How much are Turkish banks able to lend in US dollars and euros? What is the cost of those dollars and euros? At what price can they lend to customers in dollars and euros?

- Buy government bonds vs. lending to the local markets: Are banks’ properly incentivised to lend to the Turkish market?

Moderator

Managing Director, Co-Head of Corporate Origination, Loan Capital Markets, EMEA

Speakers

Chief Financial Officer

Country Head, Turkey, Eastern Europe, and Central Asia

Director, Head of Financial Institutions

Managing Director, Global Loan Solutions

End of conference

Wed 24th Feb 2021, 10:30am (Europe/London)