RECOGNISING THE MOST INNOVATIVE & GROUND-BREAKING DEALS FROM THE MIDDLE EAST

BOOK YOUR TABLE HERE

RECOGNISING THE MOST INNOVATIVE & GROUND-BREAKING DEALS FROM THE MIDDLE EAST

BOOK YOUR TABLE HERE

RECOGNISING THE MOST INNOVATIVE & GROUND-BREAKING DEALS FROM THE MIDDLE EAST

BOOK YOUR TABLE HEREJoin the industry's most high-profile figures in celebrating!

Since 2014, the Bonds & Loans Awards has been recognising the most innovative and ground-breaking deals from Sovereign, Corporate and Financial Institution issuers and borrowers.

The exhaustive selection process involves close examination of deal size, tenor, structure, and distribution; analysis and background of the borrower and their accessibility to financing; with extra credit for those deals demonstrating high quality execution, accessing new pools of liquidity, innovative structuring, and opening-up new markets.

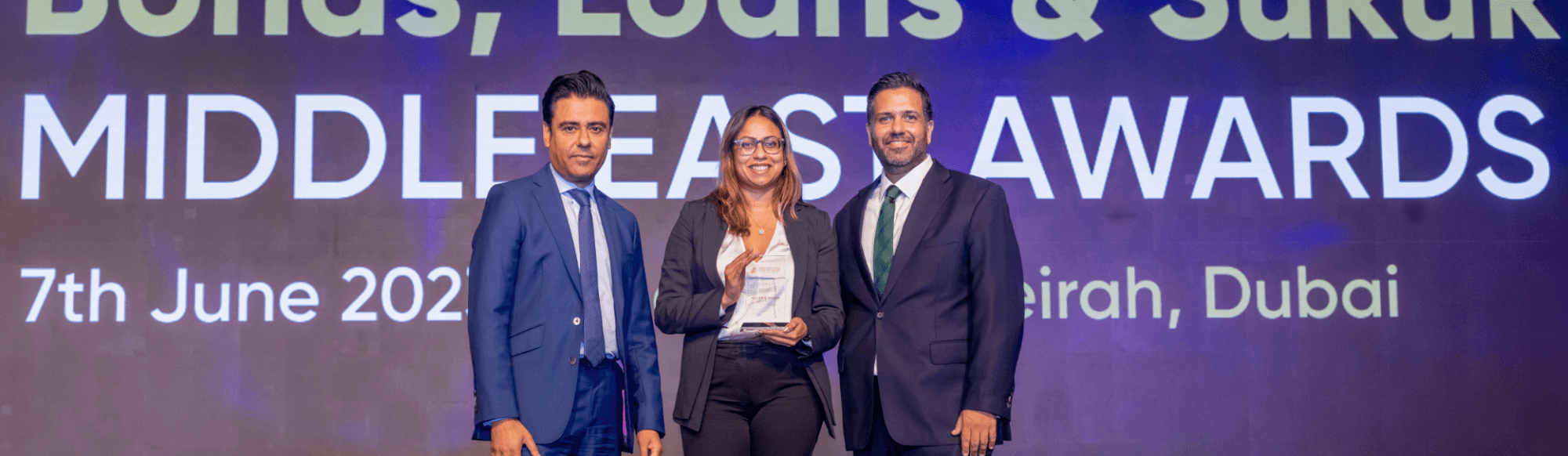

Bringing together the industry’s most high-profile figures, the Bonds, Loans & Sukuk Middle East AWARDS ceremony is an opportunity to raise the profile of the financial markets with the international investment community, and to inspire future issuance by Middle Eastern companies.

ENQUIRIES: email Awards@GFCMediaGroup.com

National Debt Management Center, Kingdom of Saudi Arabia

Mamoura Diversified Global Holding PJSC (Mubadala)

DP World

Emirates NBD Bank

National Debt Management Center, Kingdom of Saudi Arabia

First Abu Dhabi Bank

M42

Abu Dhabi Future Energy Company PJSC – Masdar

Barakah One Company PJSC

Al-Shuaibah

Lulu International Holding Ltd

Abu Dhabi Ports Company

Saudi Electricity Company

Dubai Aerospace Enterprise

RGE

Borouge 4 LLC

Aldar

AviLease

Dubai Taxi Company

M42

Public Investment Fund

Majid Al Futtaim

FIVE Holdings

Rawabi Energy Company

Public Investment Fund

Public Investment Fund

Abu Dhabi Islamic Bank

Energy Development Oman

Kingdom of Bahrain, Ministry of Finance and National Economy

Standard Chartered Bank

Citi

Citi

Standard Chartered Bank

Emirates NBD Capital

HSBC

First Abu Dhabi Bank

First Abu Dhabi Bank

HSBC

First Abu Dhabi Bank

Emirates NBD Capital

First Abu Dhabi Bank

First Abu Dhabi Bank

Standard Chartered Bank

HSBC

First Abu Dhabi Bank

National Debt Management Center, Kingdom of Saudi Arabia

The Public Investment Fund

First Abu Dhabi Bank

Majid Al Futtaim (MAF)

ACWA Power

Allen & Overy LLP

Allen & Overy LLP

Linklaters LLP

Allen & Overy LLP

Wafra

Azimut

Arqaam Capital

Azimut

FIM Partners

Franklin Templeton

| Deal of the Year Awards | Awards for Excellence | Investor Awards |

|---|---|---|

| Sovereign, Supra & Agency Bond Deal of the Year | Debt (Bonds & Loans) House of the Year | Best Private Credit Fund Strategy |

| Quasi-Sovereign/GRE Bond Deal of the Year | Loan House of the Year | Best Global Sukuk Fund Strategy (1 Year) |

| Corporate Bond Deal of the Year | Middle East Investment Bank of the Year | Best Global Sukuk Fund Strategy (3 Years) |

| Financial Institutions Bond Deal of the Year | ESG Bond House of the Year | Best MENA Equity Fund Strategy (1 Year) |

| Syndicated Loan Deal of the Year | ESG Loan House of the Year | Best MENA Equity Fund Strategy (3 Year) |

| Local Currency Bond Deal of the Year | High Yield Debt House of the Year | Best MENA Fixed Income Fund Strategy (1 Year) |

| Local Currency Loan Deal of the Year | Leveraged Finance House of the Year | Best MENA Fixed Income Fund Strategy (3 Years) |

| ESG Bond Deal of the Year | Structured Finance House of the Year | |

| ESG Loan Deal of the Year | Project Finance House of the Year | |

| Project Finance Deal of the Year | International Equity Capital Markets House of the Year | |

| Structured Finance Deal of the Year | Local Equity Capital Markets House of the Year | |

| Infrastructure Finance Deal of the Year | Sovereign, Supra & Agency Treasury & Funding Team of the Year | |

| Power Finance Deal of the Year | Quasi-Sovereign/GRE Treasury & Funding Team of the Year | |

| Transport Finance Deal of the Year | Bank Treasury & Funding Team of the Year | |

| Natural Resources Finance Deal of the Year | Corporate Treasury & Funding Team of the Year | |

| ECA, DFI & IFI Deal of the Year | Project Sponsor of the Year | |

| Real Estate Finance Deal of the Year | Debt Capital Markets Legal Adviser of the Year | |

| Acquisition Finance Deal of the Year | Banking & Finance Legal Adviser of the Year | |

| Equity Capital Markets Deal of the Year | Equity Capital Markets Legal Adviser of the Year | |

| M&A Deal of the Year | Sukuk Legal Adviser of the Year | |

| Sukuk Deal of the Year | Sovereign, Supra, Agency Bond House of the Year | |

| Liability Management Deal of the Year | Corporate Bond House of the Year | |

| High Yield Debt Deal of the Year | Financial Institutions Bond House of the Year | |

| Leveraged Finance Deal of the Year | Local Currency Debt House of the Year | |

| Ground-Breaking Deal of the Year | Sukuk House of the Year | |

| Islamic Capital Markets Deal of the year | ||

| Global Financial Institution Sukuk Deal of the Year | ||

| Global Corporate Sukuk Deal of the Year | ||

| Global Sovereign Sukuk Deal of the Year |

VIP Table (for up to 10 people) situated in the first row with champagne served: £12,900

Premium Table (for up to 10 people): £10,900

Tables sell out very quickly and we operate on a first come first served basis.

Contact us today to secure your table at: Awards@GFCMediaGroup.com

or:

If you would like to stay at the Jumeirah Madinat Mina A Salam you can find the current rates below. Please note: room rates are for 3-6 June 2024 only (subject to availability).

Please find the group link below, the link contains default arrival and departure dates (3rd – 6th June 2024) number of rooms (1) and number of guest (1), please note, if you wish to alter the dates, click on EDIT buttons on the right side of the availability page.

Group Name: Bonds Loans & Sukuk Middle East 2024

Group Code: GFC020624

Group Link: Bonds Loans & SuKuK Middle East 2024

If you have any questions please contact: Katie.Evans@gfcmediagroup.com