The Middle East’s largest corporate and investment banking event

REGISTER YOUR DELEGATE PLACE

The no. 1 business meetings facilitator for the Middle East's capital markets

REGISTER YOUR DELEGATE PLACEAre you active in the Middle East's capital markets? Do you want to expand your business in this space?

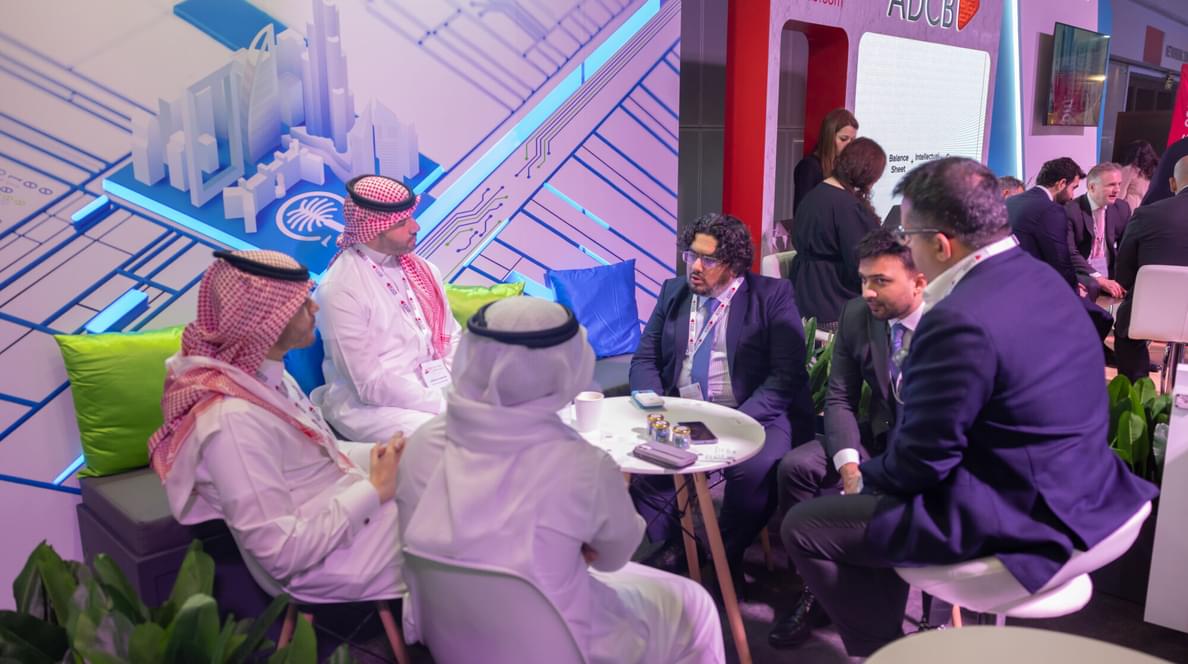

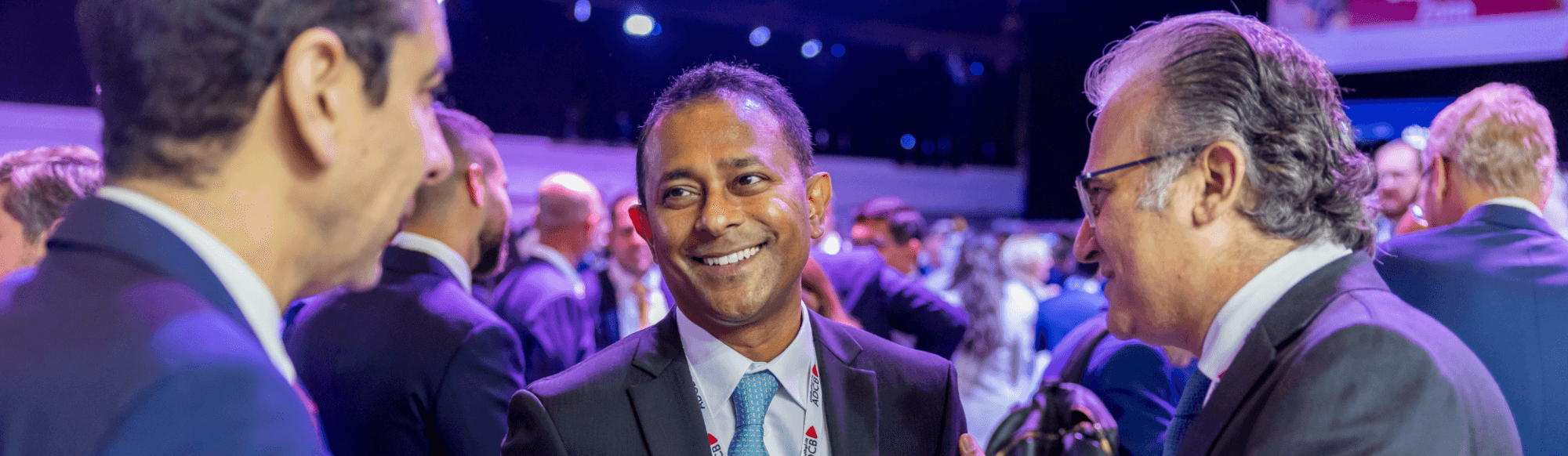

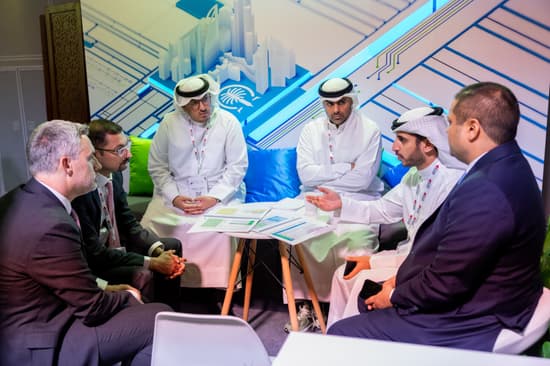

We are the no. 1 business meetings facilitator for the Middle East's capital markets. This is the annual meeting place for senior decision-makers from the Middle East's capital markets community. This in-person event will bring together 1,400+ leading governments, corporates, investors, banks, law firms, regulators and service providers in 1 location, and feature 75+ expert speakers.

Attendees use this unique gathering of Global capital markets leaders to re-connect with existing clients, build strong business relations with prospects and hear the market's financial leaders speak on how they are navigating the current economic climate/share their expectations for the year ahead.

ALL ENQUIRIES: email Marketing@GFCMediaGroup.com

Please submit your details below to download the file. By clicking the ‘send’ button, you agree to the terms of our Privacy Policy.

"Accelerating Middle East IPOs"

Equity Capital Markets is the event that will connect the region’s leading ECM players to quicken the evolution of the region’s equity capital market. It will run concurrently with the main event, taking place on Day 1 of Bonds, Loans & Sukuk Middle East 2024, but present its own agenda and speakers.

*This event is open to all attendees*

"Connecting MENA allocators, managers, and borrowers with the global private credit market"

Global Private Credit is the event dedicated to broadening funding and global private credit opportunities in MENA. It will run concurrently with the main event, taking place on Day 2 of Bonds, Loans & Sukuk Middle East 2024, but present its own agenda and speakers.

Bringing together the private credit community, this gathering of global senior decision-makers will:

*This event is open to all attendees*

MEETINGS & NETWORKING

WE ARE THE NO. 1 BUSINESS MEETINGS FACILITATOR FOR THE MIDDLE EAST'S CAPITAL MARKETS

EXPERT MARKET INSIGHTS:

The Middle East's largest corporate and investment banking event is also complemented by an agenda of expert market insights provided by 70+ industry leading speakers, allowing attendees to hear how the region's local & international financial leaders are navigating the current economic climate/share expectations for the future and benchmark.

WE ARE THE ONLY EVENT TO:

| 07:45 |

Registration and networking |

| 09:00 |

The C-Suite Perspective: Financial strategies and approaches from the region’s top corporates

SpeakersChief Financial Officer Chief Financial Officer Chief Financial Officer |

| 09:45 |

GCC macroeconomic trends & 2024/25 outlook: What are the expectations for GDP growth across GCC economies? How are sectors across the GCC being impacted by market uncertainty?

ModeratorChief Economist and Head of Research SpeakersPortfolio Manager Vice President, Senior Credit Officer, Sovereign Risk Group Senior Portfolio Manager |

| 10:25 |

Adapting to uncertainty from Issuer to Investor: What are the funding strategies from the region’s issuers?

ModeratorHead of Leveraged & Acquisition Finance SpeakersExecutive Director, Capital Markets, AME Director, Debt Capital Markets, MENA |

| 11:10 |

Networking break |

| 11:40 |

Unravelling liquidity, competition, risk appetite and the impact on the loan market

ModeratorManaging Director, Head of Loan Syndicate & Distribution SpeakersSenior Director - Global Loan Solutions Director, Loan Syndication, Sales & Distribution Head of Emerging Markets, Financial Institutions & Benelux - Loan Capital Markets EMEA Managing Director, Head, Loan Syndicate, MENAP |

| 12:25 |

GCC Credit Outlook 2024/25: Regional fundamentals vs global economic uncertainty: How is the region contrasting to the rest of EM and developed markets?

SpeakersPortfolio Manager, Head of Fixed Income Portfolio Manager Head of Debt Capital Markets and Syndicate Head of EMEA Debt Capital Markets Head of CEEMEA Syndicate Executive Director, Portfolio Manager |

| 13:10 |

Keynote: Facing a New Reality: AI – the Good, the Bad and the UglySpeakerDigital Futurist |

| 13:40 |

Networking lunch |

| 15:00 |

Oxford-Style debateJoin us for an engaging Oxford-style debate on the following motion: "This House believes that local and regional banks are better placed than international banks to service issuers and borrowers in MENA" In this structured format, two teams will rigorously present and defend their positions – one supporting the motion and the other opposing it. Be prepared for a dynamic exchange of ideas and compelling arguments, as our expert speakers compete to sway your perspective on this thought-provoking topic. N.B. Please note that the purpose of this session is to engender thought-provoking and entertaining debate. The views expressed do not necessarily reflect the institutions represented. |

| 15:40 |

Public debt management amidst market volatility: How are MENA public finances being impacted by the new rate environment?

SpeakersDirector, Debt Management Managing Director, Head of MEAAT DCM General Manager of Financial Institutions & Investor Relations, and Sustainable Development Director, Debt Capital Markets MENA Director, Financing Operations |

| 16:25 |

Climbing the maturities wall: How are corporates approaching refinancing in the face of upcoming maturities?

SpeakersDirector, Investment Banking Head of Corporate Debt Capital Markets, Middle East and North Africa Head of Debt Capital Markets & Loan Syndication Head of Treasury |

| 17:10 |

Chairperson’s closing remarks and close of Day One |

| 08:15 |

Registration and networking |

| 09:00 |

Keynote Address – Six months on from COP28: What does the “beginning of the end” of the fossil fuel era mean for the Middle East?

|

| 09:30 |

To what extent does ESG financing still offer a pricing advantage? What are the long-term benefits to companies beyond the ‘greenium’?

SpeakersVice President, Sustainable Debt Capital Markets Director, Corporate Finance and Treasury Co-Head of Emerging Markets Corporate Fixed Income Head of Banking Vice President, Sustainable Finance Solutions Director, Sustainable Finance |

| 10:15 |

Building a credible plan for the energy transition: Balancing sustainability, energy security, and affordability

SpeakersVice President - Corporate Finance & Investor Relations Regional Head of Sustainable Finance, MEA Head of Sustainability and Climate Change |

| 11:00 |

Networking Break hosted by Mashreq |

| 11:30 |

Unlocking long-term capital for projects: How can large-scale projects shift from reliance on local financing and successfully access international markets?

SpeakersHead of Sustainable, Asset & Project Finance Head of Project and Structured Finance Head of Corporate Finance and Syndications Managing Director, Head of Project & Asset Based Origination, Loan Capital Markets |

| 12:15 |

Islamic finance: The expanding reach and depth of sukuk

ModeratorPartner SpeakersPortfolio Manager, Corporate Credit Funds Executive Director, Debt Capital Markets Deputy Treasurer Global Head of Islamic Finance Head of Debt Capital Markets |

| 13:00 |

Networking Lunch |

| 14:00 |

How are GCC banks managing liquidity and different sources of funding?

SpeakerHead of Treasury & Capital Markets |

| 14:45 |

How should institutions measure, disclose, and align their ESG credentials to secure greater international investment?

SpeakerChief Financial Officer |

| 15:30 |

Close of conference |

| 12:10 |

The IPO outlook for 2024/25: How is the market landscape changing?

|

| 12:55 |

The path to diversification: Increasing the quantity of private company listings

|

| 13:40 |

Networking Lunch |

| 15:00 |

Bolstering the secondary market: what’s next for developing the region’s active equity capital market?

|

| 15:45 |

Increasing international investor allocations: Exploring diverse investment strategies in the context of the Middle East's active equity markets

|

| 16:30 |

Effective corporate governance & transparency: Creating long-term value for companies and investors

|

| 17:15 |

Close of Conference |

| 09:00 |

Keynote InterviewsIn this session, key players from the global private credit market will set the tone – giving their perspectives on navigating the complexities of the market. Quickfire interviews will be held with key stakeholders representing various facets of the industry, including regulatory bodies, top global firms and sovereign funds. |

| 09:30 |

CEO’s panel: Private Credit Market strategic outlook

|

| 10:15 |

Investor’s Panel: How can GCC allocators continue to succeed in investing in Private Credit?

SpeakerPrincipal |

| 11:00 |

Networking Break hosted by Mashreq |

| 11:30 |

Private credit vs. private equity vs. bank loans: Why and how do companies choose to raise capital through Private Credit? How do they do it?

SpeakersCo-Founder & CEO Chief Executive Officer Partner, APAC Credit & Emerging Markets, & Co-head of Yield Multi Credit |

| 12:30 |

What is the outlook for real-estate private credit?

|

| 13:30 |

Lunch Break |

| 14:30 |

Close of conference |

We are the number 1 business meetings facilitator for the global capital markets

1,400+ SENIOR CAPITAL MARKETS ATTENDEES | HIGH-QUALITY NETWORKING WITH A HIGH-QUALITY AUDIENCE | PRE-ARRANGED BUSINESS MEETINGS WITH THE MOST SOUGHT-AFTER ATTENDEES

Please submit your details below to download the file. By clicking the ‘send’ button, you agree to the terms of our Privacy Policy.

OUR DEDICATED MEETINGS CONCIERGE TEAM PRE-ARRANGE AND SCHEDULE YOUR TARGETED SPONSOR 1-2-1 MEETINGS, SO YOU CAN GET IN FRONT OF YOUR CLIENTS AND PARTNERS TO:

ESTABLISH RELATIONSHIPS, IMPROVE CONNECTIVITY, DISCUSS BUSINESS AND MOVE DEALS ALONG

Our customers utilise the 1-2-1 Meetings Concierge Service to secure face time with the most sought-after attendees at our events. The service allows you to schedule meetings pre-event, ahead of anyone else, helping you build relationships with active issuers, borrowers, investors & financiers.

We will:

1. Send you the delegate list before the event

2. Send the meeting requests on your behalf

3. Alert you of who would like to meet with you

4. Send you your meeting schedule pre-event

5. Provide onsite meeting support

Set the values below to calculate the size of the opportunity.

If you would like to stay at the Jumeirah Madinat Mina A Salam you can find the current rates below. Please note: room rates are for 3-6 June 2024 only (subject to availability).

Please find the group link below, the link contains default arrival and departure dates (3rd – 6th June 2024) number of rooms (1) and number of guest (1), please note, if you wish to alter the dates, click on EDIT buttons on the right side of the availability page.

Group Name: Bonds Loans & Sukuk Middle East 2024

Group Code: GFC020624

Group Link: Bonds Loans & SuKuK Middle East 2024

If you have any questions please contact: Katie.Evans@gfcmediagroup.com