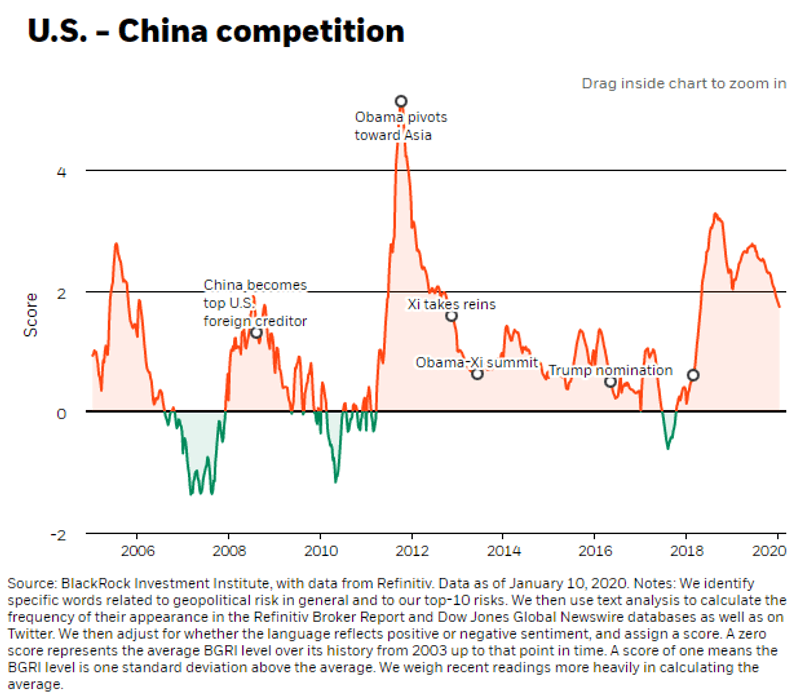

In a note from the BlackRock Investment Institute, the economic research division of the fund manager, Global Chief Strategist Mike Pyle, Chief Fixed Income Strategist Scott Thiel, and Head of Macro Research Elga Bartsch explain that while the US-China trade conflict that pervaded much of 2019 has paused, the “enduring strategic rivalry” between the two countries will continue yet.

They also say technology, cybersecurity, and growing inequality – which has and will continue to lead to widespread protest and the rise of populism in many countries – will be key risks to look out for throughout the year.

“First: We are seeing fragmentation at a global level across a range of dimensions, including ideology, trade and technology. Technology decoupling between the U.S. and China is underway and will force countries and businesses to navigate this evolving landscape. We expect such tensions to persist even after a limited “Phase 1” trade deal that may temporarily defuse U.S.-China trade tensions. Domestically, political polarization is reaching a high point in many countries. The U.S., for example, faces a contentious presidential election with the potential for starkly divergent policy outcomes.”

“The second is an increase in global protests, partly fuelled by rising income and wealth inequality and facilitated by social media. Many governments are ill-equipped to respond. With limited monetary and fiscal manoeuvring room, this could lead to further unrest in any downturn.”

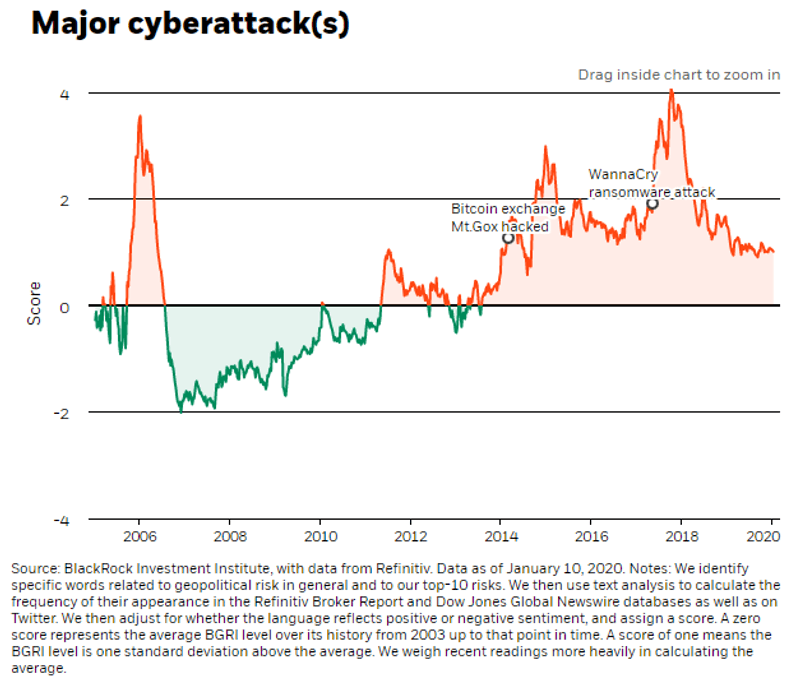

“The third is cybersecurity. Tensions are elevated between the U.S. and many adversaries such as Iran and North Korea, which have the capability to mount attacks on critical infrastructure and institutions. An uptick of “ransomware” attacks against cities and states with relatively poor defences may be a sign of things to come. Markets look to be complacent about such risks: the attention to cyber-attacks has been on a steady decline since late 2017, our [BlackRock Geopolitical Risk Indicator] shows. U.S. Treasuries and their inflation-protected peers have done well to cushion portfolios against recent risk selloffs – and we prefer them in both tactical and strategic portfolios. Government bonds in Europe and Japan have diminished ability to serve such as role as their yields near lower bounds.”

While a recent escalation in gulf tensions has heightened the risk of another war breaking out in the Persian Gulf, the market’s reaction has been relatively muted despite a brief widening of sovereign bond spreads and a spike in the spot price of oil – both of which have since retreated. BlackRock says this is in part a reflection of the Middle East’s diminishing role in setting the price of crude globally.